What's a Stock Screener? A Primer to Get You Started

Get Started with TD Direct Investing

Would you like more information?

When it comes to investing, the stocks you choose can play a big factor in determining your earning potential. Whether it's your first trade or your 100th, it never hurts to do your own research when building your portfolio. This is where screeners come in. While WebBroker provides an ETF screener and Mutual fund screening tools, this deep dive will focus solely on stock screeners. Let's get into it.

What are stock screeners?

Accessed through the WebBroker platform, stock screeners enable self-directed investors to define exactly what they're looking for when it comes to investing – finding that needle in a haystack so to speak. Stock screeners select investments using fundamental and technical analysis, which may help you make an educated decision when it comes to building your portfolio. The screeners available to use range from preset screens, to screeners created by the community, and for those who want to do their own thing, there's always the option to create a custom screen.

What are the benefits of trading within a strategy?

Using stock analysis and following a strategy to choose your investments has advantages. Here are the top five:

-

Analysis: We all hear about stocks that people talk about investing in, however when you use a strategy to analyze them, you're also able to see how they stack up to other similar stocks that you may have never discovered otherwise.

-

Education: You can learn how others evaluate stocks. What do they look for? Should you be looking for that too?

-

Automation: Once you've set up stock screeners that work for you, set up alerts through WebBroker directly to your email to deliver the latest stock analysis and investment opportunities daily, weekly or monthly. It's that simple.

-

Diversity: It can be easy to only look up individual stocks and not know what else is out there —stock screeners provide a selection of stocks so you can work to diversifying your portfolio.

-

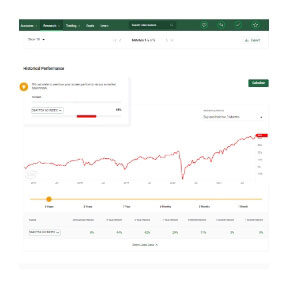

Past Performance: While looking at past performance doesn’t guarantee future results, it can provide some insight into how a stock has performed and offers a glimpse of how the stock could perform in the future. Through WebBroker, investors are offered the opportunity to back test stocks within the screener tools to take a look into a strategy's past performance to understand how different investment basics may impact their portfolio performance.

Choosing the right stock screener for you

Just as it's important to choose the right stock for you, it's also important to choose the best stock screener to help you build or enhance your portfolio as a self-directed investor. Think of these screeners as different options to help deliver a much more knowledgeable investing experience.

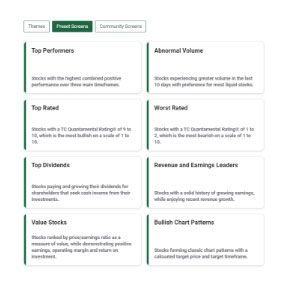

Preset screens – Within the screeners tool on WebBroker, are a number of preset screens, which are strategies for investors to use as a starting point. Preset screens are a great building block for a novice getting started with investing or for anyone to simply see a quick list of a certain type of stocks without the need to build from scratch.

These preset strategies include stock screeners for:

-

Top Performers

-

Abnormal Volume

-

Top Rated

-

Worst Rated

-

Top Dividends

-

Revenue and Earnings Leaders

Don’t see a screen you're interested in? Not to worry, there are more preset strategies to discover within the WebBroker platform as soon as you're ready to dive in.

Expert strategies screen – Expert strategies screeners are typically ideal for investors who understand stock analysis a bit more than say a novice investor. These screeners are back-tested and can be used in day-to-day trading activities to screen the market.

Community screens – Ever wondered what strategy other investors are using? Wonder no more with community screens. These are stock screeners created by other members of the WebBroker community that they use for their own stock analysis and have given TD permission to share with other TD Direct Investing clients/community. While you may not use these screens for your own strategy (or maybe you will), it can give you a good idea of what is of importance to others when it comes to investing and help you focus on what is important for your own analysis.

Custom Screens – Not seeing a screen that works for you? Just like customizing a car, you can customize your very own stock screener. Simply mix and match from the pre-defined tags in WebBroker and create a screen with a strategy that makes sense to you. These screens are geared more towards advanced investors who know exactly what they're looking for when it comes to analyzing investments before they buy/sell.

Investing in screeners that inspire you – A great feature within the screeners tool is the ability to discover screens based on trending topics, such as: 5G, autonomous vehicles, cannabis, COVID-19 vaccines, and more. These themes are updated monthly based on current trends. This feature was created with anyone following trends in mind as a unique way for them to discover strategies that are of interest to them.

Getting started with a screener

Now that you've read about the different screens available to you, you can start using them. Once you've logged into WebBroker, simply tap on the research tab and select screeners under Tools. Once you've accessed the tool, the first step of using stock screeners is identifying what you need in a strategy. If you're a novice, you may want a preset or community screen. Looking for something more advanced? Then you may want to choose a screener that you can curate based on what's important to you in a stock.

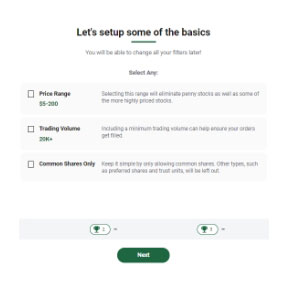

Using the getting started tool – If the choice of screen is overwhelming, have no fear, there's a tool for that. In the right-hand corner of the page is the getting started tool to help you build a strategy. As you build, you can learn about what each criterion means for the stock selection and why you might consider using it within your screener, and in just 5 taps you'll have your own personalized screen.

Additional features to enhance your strategy

As a self-directed investor, you'll want to do as much research as you can, and receive all the help you can get. TD Direct Investing is there to deliver with enhanced features within their screeners tool. These include:

- Ranking API: An API is a connection between computers or computer programs. It is a type of software interface, which offers a service to other pieces of software. In this case, it allows for flexible integration, showing investors where a stock is ranked based on performance within its sector. When speaking about sectors, we're referring to the 11 Global Industry Classification Standard (GICS)1 sectors that include Energy, Materials, Industrials, Consumer Discretionary, Consumer Staples, Health Care, Financials, Information Technology, Real Estate, Communication Services and Utilities.

- Back testing: With the back-testing feature in the screeners tool, you can see how different investment criteria may impact your portfolio based on past performance. You can then choose to create variations of their original strategy and retest to compare how their refinements to investment criteria contributed to better or worse returns.

Learn as you go

Ready to seize the day and start investing strategically using stock screeners? You can learn as you go, helpful descriptions of each criteria are displayed within the platform as you build a strategy.

Catch the screeners tool in action

For a more hands-on educational experience, TD Direct Investing is providing an exclusive webinar, hosted by Ryan Massad on April 7th 2022, with special guest Gary Christie of Trading Central, who will be discussing the screener tool and how to use it. To register click here. Has the date passed? This webinar will be available on demand here.

Share this article

Open an account online – it's fast and easy

Whether you're new to self-directed investing or an experienced trader, we welcome you.