@TDAM_Canada

Investor Knowledge + 5 Minutes = New Thinking

It wasn't supposed to be this way

Two years ago, the prevailing narrative was that inflation was transitory and that central banks would have years to gradually raise rates to bring the economic dynamics back into equilibrium. Even policymakers projected that inflation would remain at or below their 2% targets for 2022 and beyond.

At that time, it was thought that pandemic-related inflationary disruptions would soon be overwhelmed by the slow moving, disinflationary structural forces that dominated the "lower for longer" rates world for much of the 2010s. Fast forward to today and that all seems like a pipe dream.

What is an investor to do?

Investors today face a significant amount of uncertainty over whether now is a good time to buy bonds given the risk of further central bank rate hikes. Some data shows that actual economic performance remains strong, while other data shows economic activity may contract at some point in the future. This divergence in data creates a very challenging forecasting environment for investment professionals and an even harder one for investors.

From "lower for longer" to "higher for longer" and (eventually) back again?

With this challenging environment in mind, Alexandra Gorewicz, CIM, Portfolio Manager, Active Fixed Income, TD Asset Management Inc. (TDAM) recently authored an article titled Global interest rates - From "lower for longer" to "higher for longer" and (eventually) back again? The article discusses key issues investors face today including, if we will ever get back to target inflation, new obstacles including the Silicon Valley Bank (SVB) failure, Credit Suisse events and the significance of a new rate floor.

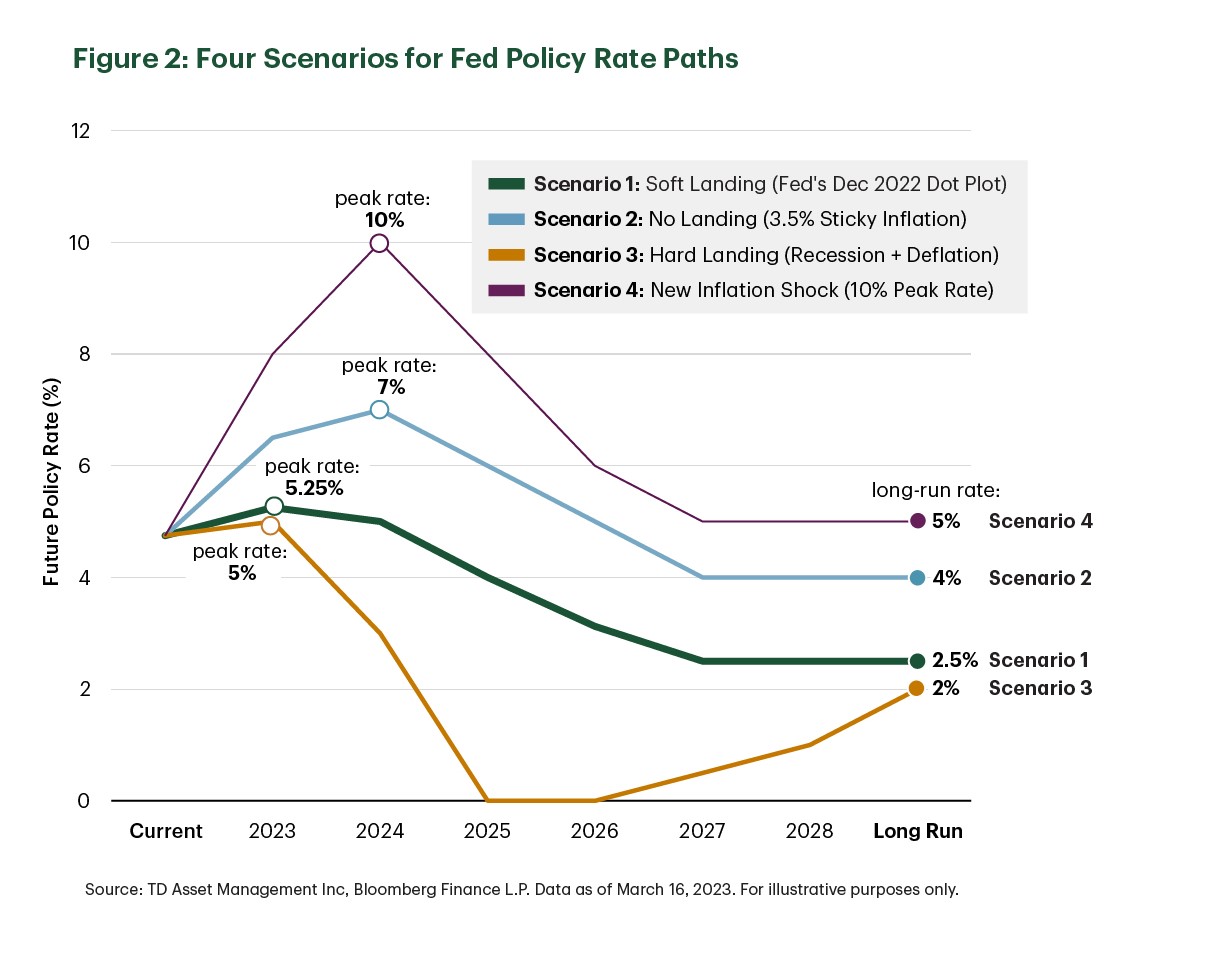

While the article is stacked with great insights, of particular interest is the section that discusses Fed policy rate scenarios. Here, Alexandra outlines 4 different scenarios (and assumptions) for Fed policy rate paths.

Scenario 1 - a soft landing: Here we assume the Fed's December-2022 economic projections are realized such that they hike to a peak rate of 5.25% this year, which gradually begins to fall next year until it reaches a long-run rate of 2.5%.

Scenario 2 – no landing: We assume that the Fed's inflation forecast for the end of 2023, which is 3.5%, becomes sticky. That is, the bulk of the easy disinflation gains occur through 2023, but due to the overwhelming macroeconomic challenges in a geopolitically fragmented world, inflation cannot fall below 3.5%. Here, we assume the Fed initially hikes the policy rate to 7%, but, in time, accepts 3.5% as its new inflation target and normalizes the policy rate to 4% (just above its new 3.5% inflation target.)

Scenario 3 – hard landing: Something breaks in the economy, in a big way. The Fed pauses at its current rate of 5% because unemployment begins to rise very quickly. As the economic contraction gains momentum and inflation falls off a cliff, the Fed begins to cut the policy rate in the fourth quarter of 2023 and ultimately cuts to 0% by 2025. Eventually, the policy rate gradually moves back up to 2%.

Scenario 4 – new inflation shock: We assume a new shock takes inflation back above 8% and the Fed hikes to a peak rate of 10% by early 2024. In time, the policy rate is lowered to 5%, which is the highest long run policy rate in all scenarios.

Opportunity in the face of uncertainty

While we attribute higher probabilities to Scenarios 1 and 2, all four scenarios help shape our outlook for interest rates in 2023. And whether we only consider Scenarios 1 and 2 or we look at all four scenarios together, we expect a positive skew in expected returns for interest rates this year. In the face of so much uncertainty, this opportunity in government bonds is as compelling as it possibly can be.

Remember to check out the full article located on our insights page.

The information contained herein has been provided by TD Asset Management Inc. and is for information purposes only. The information has been drawn from sources believed to be reliable. The information does not provide financial, legal, tax or investment advice. Particular investment, tax, or trading strategies should be evaluated relative to each individual's objectives and risk tolerance.

Certain statements in this document may contain forward-looking statements (“FLS”) that are predictive in nature and may include words such as “expects”, “anticipates”, “intends”, “believes”, “estimates” and similar forward-looking expressions or negative versions thereof. FLS are based on current expectations and projections about future general economic, political and relevant market factors, such as interest and foreign exchange rates, equity and capital markets, the general business environment, assuming no changes to tax or other laws or government regulation or catastrophic events. Expectations and projections about future events are inherently subject to risks and uncertainties, which may be unforeseeable. Such expectations and projections may be incorrect in the future. FLS are not guarantees of future performance. Actual events could differ materially from those expressed or implied in any FLS. A number of important factors including those factors set out above can contribute to these digressions. You should avoid placing any reliance on FLS.

TD Asset Management Inc. is a wholly-owned subsidiary of The Toronto-Dominion Bank..

®The TD logo and other TD trademarks are the property of The Toronto-Dominion Bank or its subsidiaries.